Financial Services organisations in Australia are ripe for disruption. The increased competition in the market is coming from far smaller organisations that are born through innovation, often created by already successful entrepreneurs (think spaceship https://www.spaceship.com.au/) that come from a technology background. These organisations move quickly, are comfortable with pushing the boundaries and are developing advanced technology that greatly increase customer experience through modernised interfaces. Obviously, the larger incumbents also have advantages in their existing market share, already established processes and existing skills and knowledge in the industry, however they need to move to modernise their approach before their more agile competitors start gaining traction in securing unsatisfied customers.

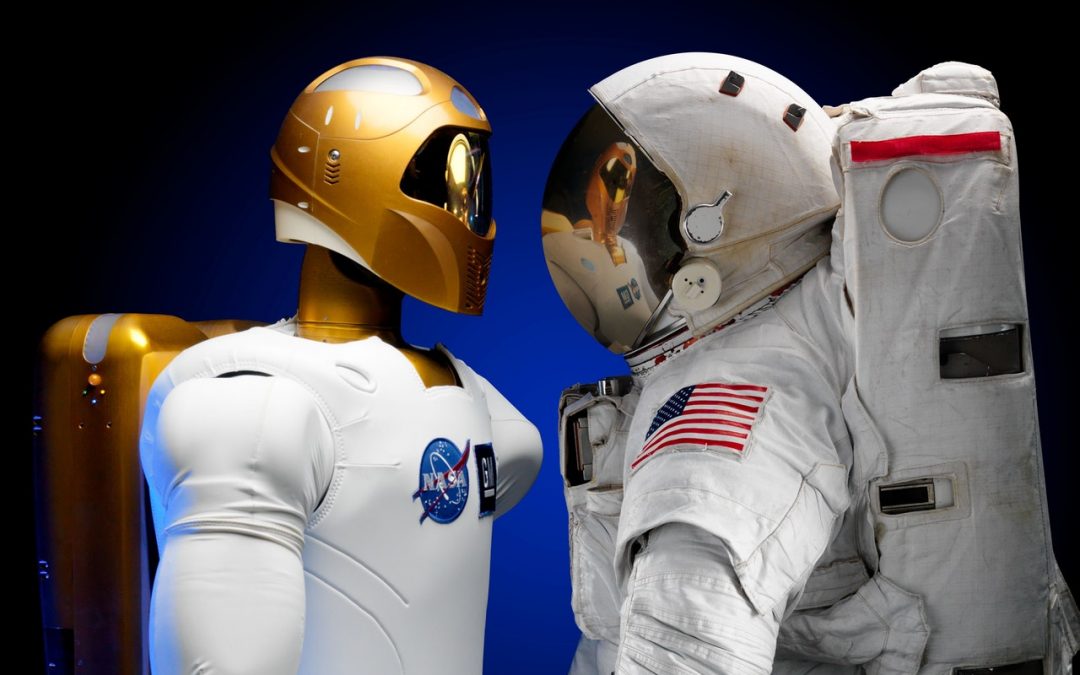

Robotic Process Automation (RPA) has been a buzz word in the industry for the last few years, only recently has it started to become a technology that’s within reach of most organisations. RPA is an excellent option where a completely new transactional system is not feasible but there is opportunity to increase efficiency in the way existing processes are carried out with largely manual interactions.

As with any project involving the manipulation of data it’s important that these projects are run with a sufficient level of governance and oversight. Carrying out a thorough process of analysis and testing is imperative to delivering successful outcomes that will be adopted by the business. As with any new technology implementation the first experience that end users have with the finished product will often shape their ongoing level of commitment to further development. 360 Managed apply a proven and consistent approach in the implementation of Robotic Process Automation technology the below high-level overview provides some insight into this process:

- COE Establishment – Establishing a Centre of Excellence for RPA within an organisation introduces a level of business buy-in that encourages an environment of continuous improvement. Within the COE, Process Owners are identified and trained. Similar to “Product Owners” in the software development world, Process Owners are stakeholders who are allocated ownership of specific business processes. Assigning accountability to these processes gives the Process Owner the ability to make decisions and assess opportunities for the deployment of robots.

- Opportunity Analysis – One of our business analysts will work with the COE to understand the existing workflow through the business and identify areas of inefficiency that may be a target for automation. In a financial services organisation this will often include highlighting areas of manual data reviews, quality assurance and validation that are often excellent candidates for automation and processing by exception. The result of the Opportunity Analysis will provide a summary document and automation roadmap focussing on the areas of the business that will likely see the greatest efficiency gain, providing the organisation with the data required to allocate an appropriate level of budget to the project.

- Project Initiation – Using the Automation Roadmap a prioritisation process is followed, and work begins on the development of the RPA deployment. The project initiation also includes the standard project initiation processes of establishing reporting requirements, checkpoint meeting attendees and agenda as well as a business owner steering committee to ensure adequate training, communication and ongoing business support is established.

- Success Review – To ensure the RPA implementation project remains on track in delivering value to the business a set of metrics are identified and measured before and after the implementation of the automated process. Depending on the investment appetite of the business progress within the project may have a dependency set on cost savings directly from previously deployed robots, providing an almost immediate return on investment. The RPA steering committee requires the delegated authority to continue allocating funding to the project if required.

One of the most important factors of a successful RPA implementation is the focus on continuous improvement. Starting with small components of processes and building through the process cycle is an incredibly powerful way of developing robust automation. Developing small user monitored automation bots not only provides a level of familiarity for the user during the process but also enabled the user to identify exceptions throughout the process that can be catered for throughout the development process. A strong set of metrics on existing processes will also provide a high level of visibility on return on investment, unlike many technology projects RPA provides a highly measurable value set.

One of the challenges that financial services organisations (specifically in Australia) face when embarking on an RPA project is the conservative approach to compliance within the industry. People will often have a general distrust for technology taking control of processes that have traditionally been processed by humans. This perception needs to be managed with statistics, showing the consistency and predictability of an efficient RPA implementation will go a long way to addressing these concerns. Quite often the first step is to implement a “process by exception” guiding principle which sees a human watching the process and identifying any errors or exceptions prior to letting the robots “into the wild”.

360 Managed have worked with several Financial Services (and other) organisations to automate repetitive tasks. From server, citrix and workstation deployments to user provisioning and off-boarding automation and business process automation we’re equipped to work with your organisation to employ the technology to increase efficiency. Contact us now for a discussion about what we can do for your business.